2024 Bendigo Rental Report Q2

Hello again and welcome to our PRD Investor Newsletter. It’s certainly been a busy quarter with the addition of a new team member as we continue to grow! This time around we’ll learn more about our Property Management superstar Jess Hemming, discover some of the trends we’re seeing as the 23/24FY rounds into the home straight, and in our Hot Topic section we talk all things tax. On we go!

Meet the team – Jess Hemming

1) How long have you lived in Bendigo? All my life

2) What’s your favourite Bendigo Restaurant? 2) Clogs (best pasta in Bendigo)

3) What’s your bucket list travel destination? 3) Travel America

4) If you could go back in time 10 years what would you tell yourself? 4) You only fail when you don’t give it a go

5) What are you watching on TV at the moment? 5) One Tree Hill – an old favourite

6) What’s your favourite thing about working at PRD Bendigo? Our PM team the support we give each other and most importantly having a good laugh

PRD in the community

One of the best things about working with PRD is the commitment to the community the business and everyone in it has.

This Easter we were proud to support Sunshine Bendigo, helping support local families in need.

We’re the major sponsor of the 130-year-old South Bendigo Football Netball Club and go out of our way to provide in-kind and financial support to many community organisations such as the CFA and local schools.

Being part of PRD Bendigo is being part of the Bendigo community.

By the numbers – Investing in Bendigo

Overview

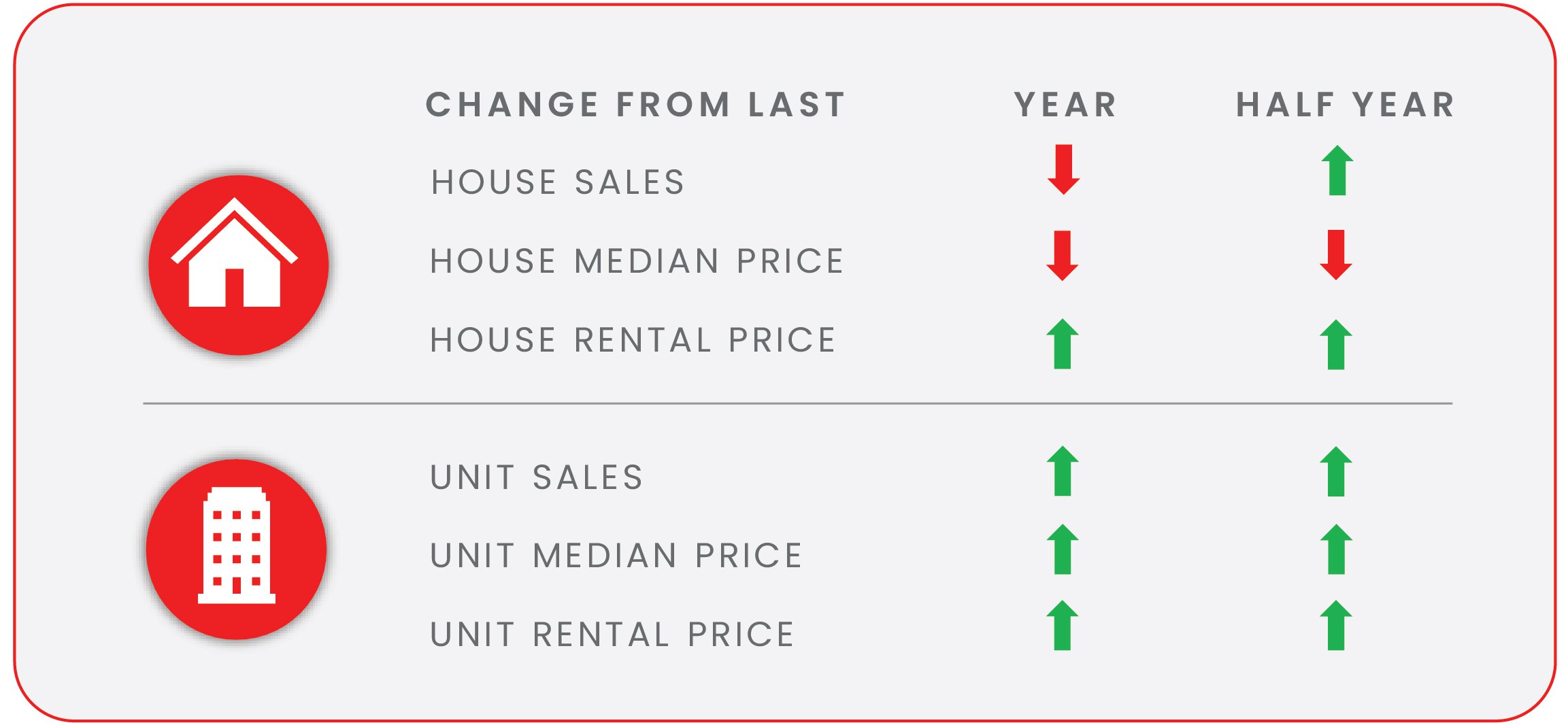

We finished 2023 with a Median House price of $570,000, a modest drop from the previous year (0.4%). That said, we finished the final quarter with a 1% jump from the last quarter so we can take some comfort in firming up prices. The gross number of sales declined as supply issues began to bite, but in true silver-lined clouds spirit, Units capitalised on the limited supply of houses and grew in every category!

Vacancy Rates

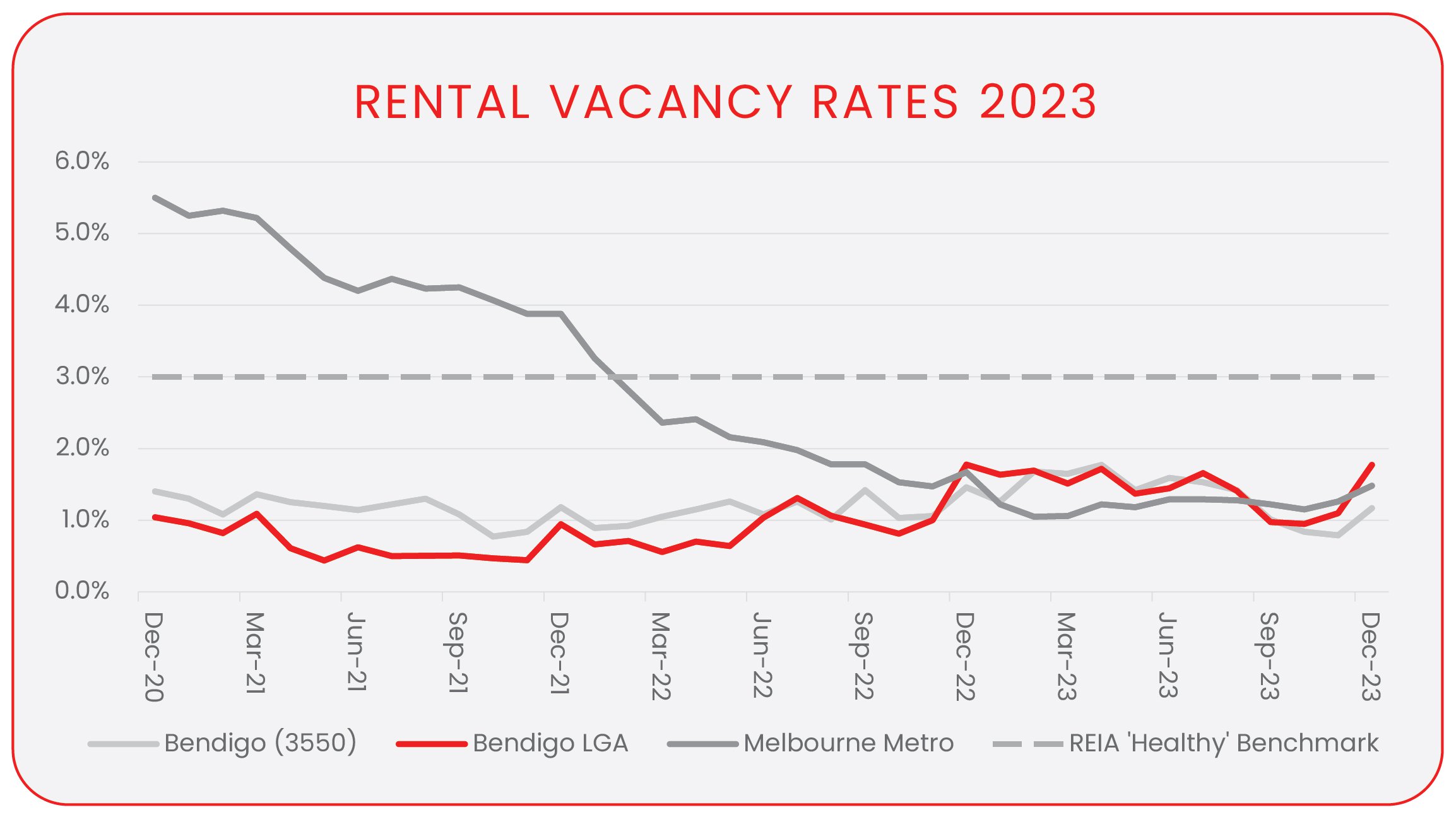

Vacancy Rates through 2023 remained well below the REIV “ideal” level of 3%, with Greater Bendigo recording an annualised vacancy rate of 1.8%. Low vacancy rates have been a feature of the Greater Bendigo residential market for some time, and the continued pressure on renters from the Metro market will no doubt see this continue.

Yields

Growth is all well and good but as we all know, growth doesn’t pay the mortgage so it was pleasing to see our yields are still outperforming the Metro market. A stabilisation of Median house price softened the full year yields for houses with the average rental yield in the Greater Bendigo LGA a shade down at 3.7%, while Units pushed on with an annualised yield of 4.6%.

Hot topic - Tax time

This will be the last newsletter for the Financial Year so naturally, it’s time to talk tax. Here are some useful tips for anyone with an Investment Property;

RECORD KEEPING - Whether you’re a courageous DIY or you use a tax agent, timely, contemporaneous record keeping is non-negotiable. Keep accurate records of your expenses. This will make preparing your return infinitely easier and make any questions from the ATO a LOT easier to answer!

DEDUCTIONS - You can claim a deduction for your share of certain expenses you incur for the period your property is rented or is genuinely available for rent. Some deductions can be claimed fully within the year the expense occurred (such as Bank Interest, Agent Fees, Rates and Repairs), while others have to be claimed over time (such as Depreciation of a new split system). Repairs tend to catch a lot of people out. Remember that there is a difference between a repair and a capital works improvement and this will affect your claim. The full cost of repairs can be claimed in full in the same financial year they are completed. An improvement or renovation, on the other hand, must be depreciated over time so be sure to understand which expense is which and claim accordingly.

INCOME - Rental and other rental-related income is the full amount of rent and associated payments that you receive, or become entitled to, when you rent out your property, whether it is paid to you or your agent. You must include your share of the full amount of rent you earn in your tax return. Remember, this can include any retained Bond amounts, or insurance payouts to compensate you for lost rent.

YOUR TAX AGENT – And finally, it’s always a good idea to research accountants to find someone who specialises in Investment Properties. You wouldn’t go see a cardiologist about a toothache so ask around about accountants. Some are great with SMSF, some are great with Businesses, and some are Investing experts. Very few are experts at it all. Sure a general tax agent can prepare your return but can they explore the dark depths of Investment Property tax law and get you every deduction you’re entitled to?

The ATO provides a detailed guide on their website which you can reference anytime. It can be accessed by using this link ATO Rental Property Guide

Remember that as part of our service, PRD Bendigo provides you with a detailed End of Year Rental Statement which will confirm the income we’ve collected for you, as well as any expenses incurred including our fees (worth every penny right?), repairs we have administered on your behalf, as well as any Council Rates and Water Bills you’ve asked us to pay out of the rent. This makes preparing your return that much easier.

Your Investment Specialist

Remember, I’m here to help. Whether you own Investment Properties already, or you’re thinking about entering the market I can help with analysis, feedback, benchmarking and industry knowledge. I’m just a phone call away and would love to help you make great choices and get the most out of investing in Bendigo!