2024 Bendigo Rental Report Q3

Hello again and welcome to the next instalment of our PRD Investor Newsletter. It’s certainly been a busy quarter as we put another Financial year in the rear view mirror. In this edition we meet another member of our team, our Team Leader Jordyn. We try to interpret some of the data from the full 23/24FY, and talk about what that means for the path forward, and we recap a year of challenges and opportunities in the Bendigo property market.e home straight, and in our Hot Topic section we talk all things tax. On we go!

Meet the team – Jordyn Saunders

1) How long have you lived in Bendigo? My whole life

2) What’s your favourite Bendigo Restaurant? The Woodhouse

3) What’s your bucket list travel destination? America

4) If you could go back in time 10 years what would you tell yourself? Stress less, it always works out

5) What are you watching on TV at the moment? Animal Kingdom

6) What’s your favourite thing about working at PRD Bendigo? Every day is different and the team at PRD

PRD in the community

One of the best things about working with PRD is the commitment to the community the business and everyone in it has. We’re excited to announce the addition of a new role within the dynamic PRD team: Brooke will be leading our Community Relations efforts.

This quarter, we were excited to donate 100 units of various clothing items to MADCOW Bendigo. MADCOW (Make A Difference, Change Our World) is an exceptional self-funded charity focused on supporting homeless services in Bendigo.

Our donation was made possible through the combined efforts of Matt, Fiona, Breach Apparel, and the entire PRD Bendigo team. We were fortunate to acquire the items at unit cost, thanks to the generosity of Breach Apparel, another fantastic Bendigo business.

Our commitment to Sunshine Bendigo continues with ongoing social media collaborations and plans for a special Christmas initiative to further support the charity.

Being part of PRD Bendigo means being deeply connected to and actively supporting the Bendigo community.

By the numbers – Investing in Bendigo

Overview

The data is in! The figures for the full 23/24 Financial Year paint us an interesting picture. Pricing has started to stabilise, vacancy rates remain well below ideal levels, and yields remain strong. While gross sales numbers are lower than previous years, there’s still ample opportunity for the astute buyer.

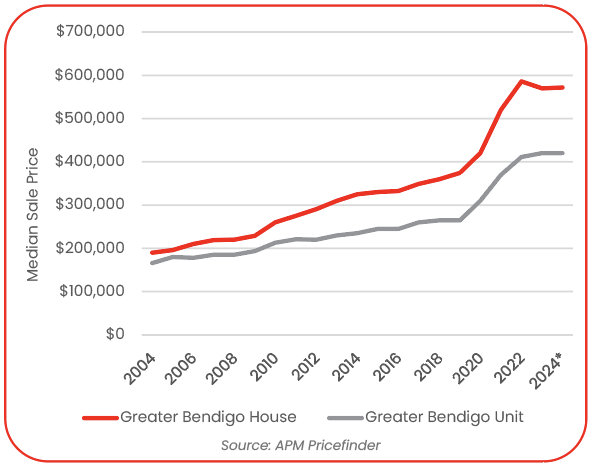

MEDIAN PRICES – Prices for the earlier part of FY24 continued to correct following the record highs of 2021, while the late part of the year saw prices start to moderate. The Greater Bendigo region saw a reduction of 1.8% in Median prices, however stripping back the data to reflect the more central 3550/3551/3555 and 3556 postcodes sees that Median house price GROW by 0.4%. Modest growth, but growth none the less which, after a 4.8% slip the year before we’ll gleefully take. All the while, the Median price of Units grew by 1.2%, continuing the 12-year growth streak for the smaller homes.

Recent Core Logic data shows the Median Price for the 3 months up to end of July 2024 has continued to decline by 1.2% but again this is the Greater Bendigo figure, which just shows why it’s important to understand the dynamics of the suburb and the market you’re planning to enter.

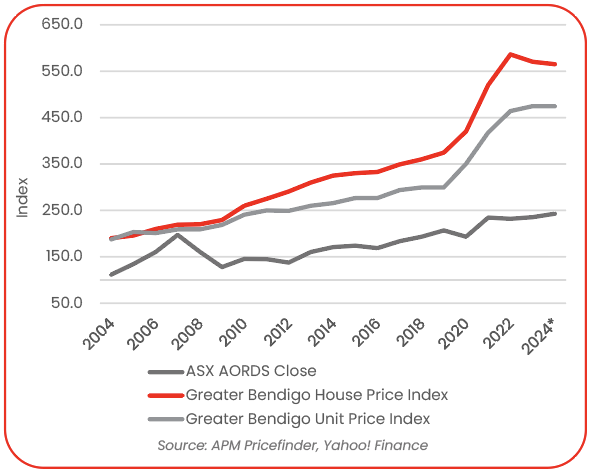

But it’s the long term growth which makes the most compelling argument. The Median house price in Bendigo has grown an astonishing 76% over the last decade, and just under 53% in the last 5 years. This long term growth rewards people with eyes on the horizon and creates a sustainable and conductive environment for investors. For those in it for the long term the rewards have been evident. The 20 year growth rate in Bendigo is a shade under an astounding 200%, well outperforming the ASX over that same timeframe.

Vacancy Rates

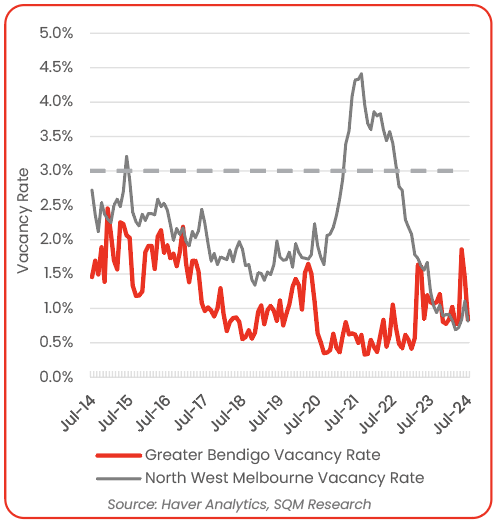

Vacancy Rates through the entire FY remained well below the REIV “ideal” level of 3%, with Greater Bendigo recording an annualised vacancy rate of 0.8% although it’s important to note that this isn’t a one-off, in fact, the 5-year average for Bendigo is just 1%. This creates a more conducive market for Investors who can list properties safely in the knowledge that extended vacancies are not a feature.

Yields

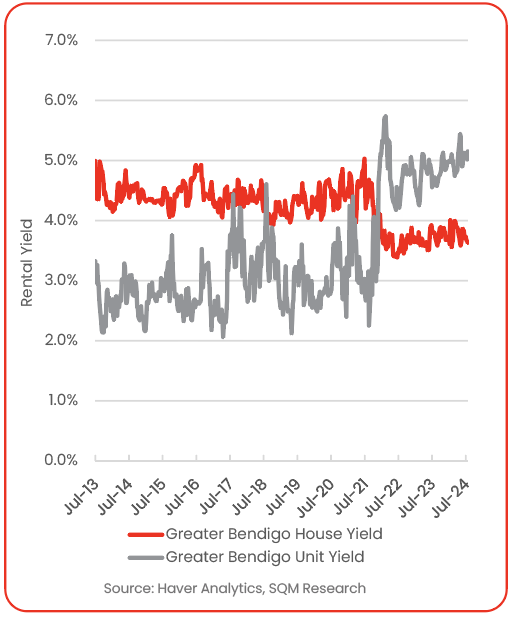

Growth is all well and good but as we all know, growth doesn’t pay the mortgage, so it was pleasing to see our yields are still outperforming the Metro market. A stabilisation of Median house price softened the full year yields for houses with the average rental yield in the Greater Bendigo LGA a shade down at 3.6%, while Units pushed on with an annualised yield of 5.2%. Each of these figures outperforms the Metro market, keeping Bendigo a highly attractive and more affordable investment option.

Reliabilty

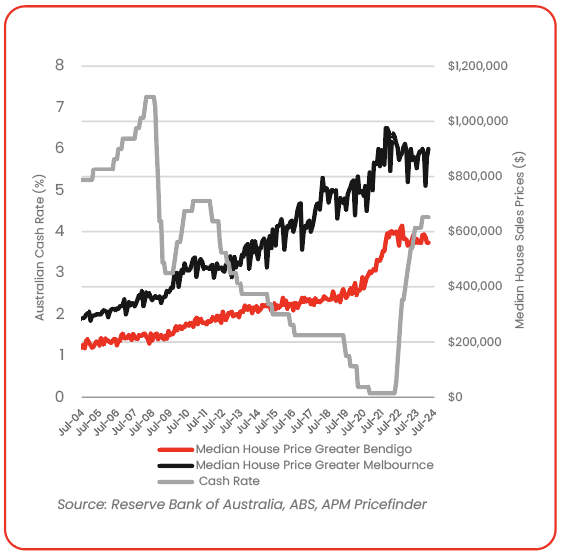

I’ve long maintained that the Bendigo market is a bit like a kid’s ride at the show. Some small ups and downs but on the whole no surprises and nothing scary. This chart outlining the growth of Median house prices compared to Cash Rate movements proves the point. The consistent growth in Bendigo has been a feature through rate hikes and rate cuts over the last 20 years. Dependable growth is evident. You’ll also contrast the comparatively straight line with the roller coaster that is the Melbourne market. Deep troughs and rapid peaks make that market anything but a kids ride!

Recap

So, what does it all mean? Pricing seems to be stabilising. A correction from record highs was always on the cards, but the turnaround to modest price growth gives us hope that the curve has bottomed and (hopefully) we’ll start to see the consistent reliable growth the Bendigo market is known for shine through. More than that though, the full year’s data highlights the reliability and attractiveness of the Bendigo market for investors. Yields continue to outperform Melbourne, but there are pockets in town where yields are well above the broader average so engage your trusted advisor early in your hunt.

Hot topic - Rents

We’ve seen a period of time with rapid rises in rents but could it be too soon to suggest the worst for renters may be over? Reserve Bank of Australia data shows Australia is once again starting to see an uptick in the number of people per household. This is in line with the latest analytics from sharehousing platform flatmates.com.au that found demand for sharehouses had rebounded to record highs in 2024. As well, migration numbers in 2024 are expected to drop from their record level the previous year.

The annual growth rate in rents had already slowed by the end of 2023 and is expected to ease further with any falls in interest rates. Rent values and interest rates tend to move together over time. Falling interest rates could also lure first homebuyers to transition from the rental market to home ownership, further easing rental demand.

That of course is not to say you shouldn’t review the market and set your rents accordingly, but the days of jumps of $100 a week are likely coming to an end.

The Year Ahead

Investing in property can be a big step, and investor sentiment in Victoria has seen a sharp decline. According to Your Investment Property Magazine, on a yearly basis, NSW notched up a 35% increase in investor lending, while QLD a 64% increase. Victoria only saw a 6.3% lift in investor lending. Based on the numbers this trend makes no objective sense. The fundamentals of the investment market are still sound, and as we’ve just discovered above, the medium – long term numbers for the Bendigo market make for a compelling argument.

I prefer to look at it this way; if there are fewer investors entering the market, there’s less competition and as an investor you’ll have something fewer people in the market have. Being solely focused on a singular cost such as Land Tax disregards the positives of the market and overlooks other costs you’ll incur going elsewhere (insurance in Lismore for example). Remember to look at the big picture and don’t become blinkered.

Your Investment Specialist

Remember, I’m here to help. There are pockets of suburbs racing ahead, while there are others being more sluggish. I can help you work out which one is which. Whether you own Investment Properties already, or you’re thinking about entering the market I can help with analysis, feedback, benchmarking and industry knowledge. I’m just a phone call away and would love to help you make great choices and get the most out of investing in Bendigo! I can also talk to you about the best Property Management offering in town. We truly offer something the others just can’t. Call me to talk more!