2024: The year that was

2024 was/is supposed to be my "come back" year.

As an investor, I wanted to return to the market this year and add to my portfolio; after "missing the boat" back in 2020/2021. Many of my fellow investors also thought this, especially those who tapped out in 2022/2023 due to cash rate hikes.

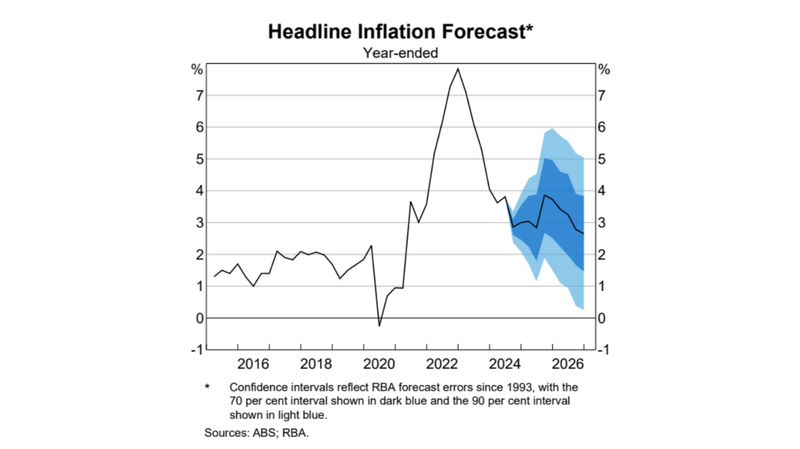

We entered 2024 with the thought that after 13 cash rate increases, there might be a chance of a cash rate cut. The Reserve Bank of Australia's (RBA) Statement of Monetary Policy in February 2024 indicated that this was a possibility, provided that our inflation rate continued to decline towards the healthy 2-3% target mark. Alas, that is not the case.

As the cash rate remained stable since November 2023, many households adjusted their budgets. We saw an increase in discretionary spending - entertainment, holidays, big purchases, etc. Fuel and electricity costs continue to rise, as do groceries and rent. Combined, this created a spike in the inflation rate; and the RBA kept the cash rate stable.

Figure 1. Headline Inflation Forecast, RBA August 2024 Statement of Monetary Policy

Further, the 2024 Federal Budget promised lower taxes and rebates, designed to add to the household budget (i.e more money). The RBA predicts, in their latest August Statement of Monetary Policy, that this addition will increase spending. When a person sees a temporary increase in income, the likelihood to spend (as opposed to save) is higher during a cost-of-living crisis; it's a chance to purchase other items or cover other costs.

What does this mean for us? Especially those waiting for a cash rate cut?

Well, we now have two scenarios:

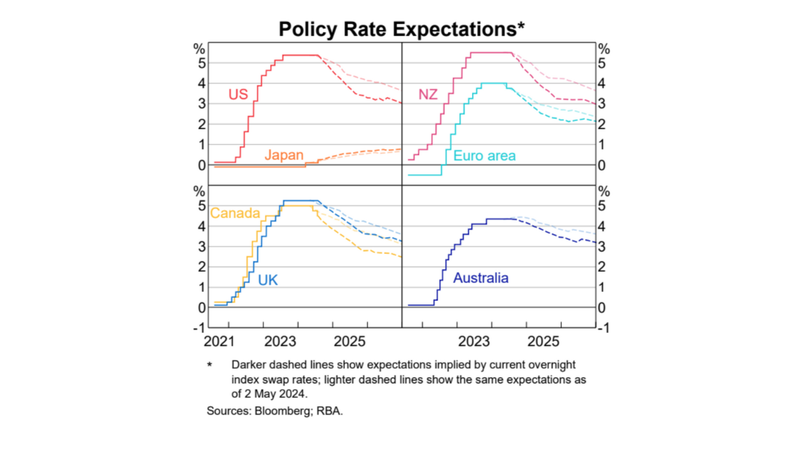

- Scenario A: The inflation rate increases from 3.8% (as of June quarter 2024) to 4.0% and above. At which point the RBA will most likely implement contractionary measures, to pull back spending, by increasing the cash rate; before, pending how inflation reacts, a possible cash rate cut in mid-2025. This is the light blue line in Figure 2.

- Scenario B: The inflation rate remains stable at 3.8% OR declines to less than 3.8% and continues to do so for another quarter. Should this occur, a potential cash rate cut in early 2025 is more likely; as evidenced in the dark blue line in Figure 2.

Figure 2. Policy Rate Expectations, RBA August 2024 Statement of Monetary Policy

Does the cash rate really matter?

A key thing to remember is that banks are not obliged by law to follow the RBA in terms of the interest rates charged to customers. Each bank is free to set its own interest rates, based on its financial structure (asset and liabilities) and viability. Already, even though there is a stable cash rate, we have seen two major banks make a move.

In the first week of October, NAB cut its fixed mortgage rates for both occupiers and investors (all fixed-rate loan terms), with a 3-year fixed rate of 5.89%. At the same time Macquarie Bank (Australia's 5th biggest bank) cut its fixed rates mortgages for two-year home loan interest rates from 5.59% to 5.39% (owner occupier only and only for people with a 30% deposit). That said, only 12 days later Macquarie Bank increased their cheapest rate to 5.69%, driven by the cost of fixed rate funding.

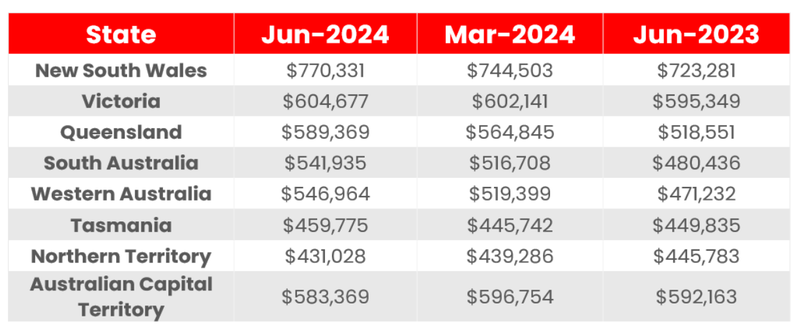

Without a doubt, the average loan amount has increased in most states, as per Figure 3. The exception is the Northern Territory (NT) and Australian Capital Territory (ACT). We are all serving bigger debts, with 48.1% (as of June quarter 2024) of the Australian median family income spent to meet average loan repayments. This is an increase from 45.5% the year prior. Those in New South Wales are the hardest hit, with 57.9% of the median family income spent on meeting monthly average loan repayments. Consistent with Figure 3, NT and ACT have the lowest percentage, of 32.4% and 33.3% respectively.

Figure 3. Average loan by State, REIA Housing Affordability Report September 2024

Waiting for a cash rate cut is a catch-22. On the one hand there is the possibility of a lower interest rate from your lender of choice. Assuming high serviceability and ability to secure funds, you can have higher borrowing power. On the other hand, a lower cash rate tends to stimulate demand, with more people competing in the market. Already we have a supply issue, thus the possibility of paying a higher price (thus higher debt) exists.

When am I making my come-back?

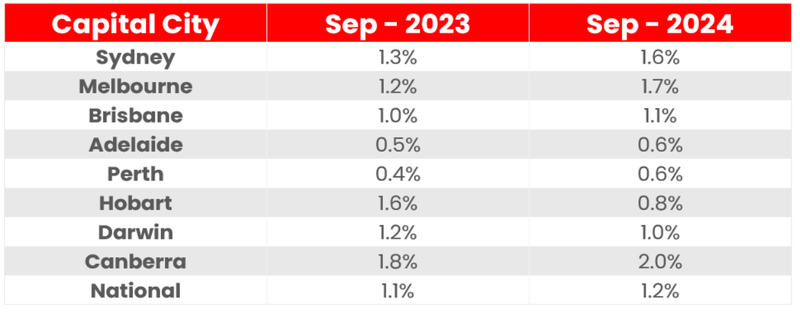

As an investor, a key indicator that I always keep an eye on is vacancy rates. This tells me whether a rental property in the area will be quickly occupied or not.

As of September 2024, the national vacancy rate was 1.2%, a slight increase from 1.1% the year prior. Most capital cities have seen slight increases, except for Hobart and Darwin (see Figure 4). However, these are only minor, with the vacancy rate all sitting below the Real Estate Institute of Australia's healthy benchmark of 3.0%. Meaning, as investors, we are still in the "safe zone".

Figure 4. Capital City Vacancy Rates, SQM Research - September 2024 data download

Three other key indicators suggest that now is the time to make that come back.

- The time-to-buy-a-dwelling index is in decline, with most buyers hesitating

- The Australian consumer sentiment was 84.6 index points in September 2024, below the 100.0 points positive line. Improvements in this index are sluggish, creating "sticky buyers" - those active in the market but cautious to sign.

- Last, new investor loan rates are high, ranging between 6.4% - 7.6% (as per RBA reading 31st August 2024); which might deter investors. Hence less competition.

From a cost-of-entry and level of competition perspective, it makes sense to re-enter the market now. That said there are other costs to consider: body corporate (most likely, due to the type of stock available), insurance, council rates and infrastructure costs, property management fees; are just the bare minimum.

Where would I go to invest? Well, to be honest, regional areas are looking attractive right now. They have the right mix when compared to the nearest capital city: affordability, higher rental yields, and lower vacancy rates. What's more, most regional areas are not so regional - my latest travels to Albury, Wagga Wagga, Bungendore, Mackay, Ballarat, Whitsundays, Bendigo, Hunter Valley, Port Stephens, and others were proof of this. In fact, these areas have the most beautiful architecture I have ever seen.

Perhaps a 2024 "come-back" is still possible. Or at least, early 2025…

Written By: Dr Diaswati Mardiasmo, PRD Chief Economist

This article was originally published on YourInvestmentProperty

Disclaimer: The information provided is for guidance only and does not replace independent business, legal and financial advice which we strongly recommend. Whilst the information is considered true and correct at the date of publication, changes in circumstances after the time of publication may impact the accuracy of the information provided. PRD will not accept responsibility or liability for any reliance on the blog information, including but not limited to, the accuracy, currency or completeness of any information or links.