Help to Buy Scheme: Does it really help First Home Buyers?

EXCLUSIVE ANALYSIS - From the Desk of the Chief Economist

The number of First Home Buyers in Australia increased by 23.6% in the past 5 years, and the amount of mortgage loan committed increased by 41.1%.

Since COVID-19 we have seen an overwhelming amount of support for first-home buyers, both at Federal and State Government levels. However, there seems to be a trade-off that buyers must bear.

On Wednesday 27th November 2024, the Commonwealth Government passed the legislation to create the Help to Buy Scheme; to be administered by Housing Australia. Its purpose is to help low and middle-income earners buy their first home, with an equity contribution from the Federal Government.

Help to Buy Scheme – The Details

Administered by Housing Australia, the Help to Buy scheme is a national shared equity scheme created to support 40,000 (open to a maximum of 10,000 eligible Australian households annually over 4 years) low and middle-income earners in their property journey. The scheme will begin once it receives Royal Assent and the Program Directions are implemented, its exact start date is to be determined.

Under the program, applicants must have a 2% deposit on the purchase price of the home. Buyers are responsible for covering all other costs such as stamp duty conveyancing fees, legal expenses etc. Property price caps also apply, depending on the location of the property.

Table 1. Help to Buy Scheme Contribution

Table 2. Help to Buy Scheme Property Price Caps

Note: Regional Centres in NSW refer to Newcastle and Lake Macquarie, Illawarra, Central Coast, Mid North Coast, Coffs Harbour – Grafton and Richmond – Tweed. Regional Centre in VIC refers to Geelong. Regional Centres in QLD refers to Gold Coast and Sunshine Coast.

Eligibility criteria include (full list available on Treasury Australia website):

- An Australian citizen of at least 18 years of age at the time of application. • Pass the income (earning up to $90,000 for individuals or $120,000 for joint applicants) and financial capacity test. That is, the applicant’s combined deposit and borrowing capacity (as assessed by a lender) is insufficient to purchase the property, without assistance from the Help to Buy program.

- The property is a principal place of residence and applicants are the sole registered owners. • The applicant is not receiving assistance from either (excluded: first homeowner grants or tax concessions, or First Home Super Saver scheme):

- A home buyer guarantee provided by a Commonwealth entity or Commonwealth company.

- A shared equity scheme.

- A loan or guarantee provided by or on behalf of a State or Territory to support home ownership; and

- The applicant does not hold a disqualifying property interest at that time. There are exceptions to this requirement, especially for single parents.

- Meets all eligible property criteria, as well as mortgage, new home contract, and timeframe requirements

What are the caveats?

As with any Government scheme, there are some caveats to consider. The first one is, what if the value of your property changes?

Section 25 of the Help to Buy Scheme explanatory statement details that if there are no special circumstances or repayments made by the participant, then the Commonwealth’s share percentage is not adjusted.

- The purchase price is $500,000 and the Government contributed $100,000. The Commonwealth share percentage is thus 20.0%. Later, the property is valued at $600,000 and the Government’s share percentage unchanged. The Government’s share in the property is now $120,000. If the value is lower, at $400,000, the Government’s share would be valued at $80,000.

- The exception is if at settlement, the property is valued at lower price (compared to purchase price) by the bank/lender. For example, if the purchase price was $500,000 however the final valuation was $475,000. The Government’s share is calculated as $100,000 divided by $475,000, rather than the purchase price of $500,000. This adjustment increases the Government’s share from 20.0% to 21.05%.

Another caveat to consider is,

What if you decide to renovate the property and upon valuation, its market value has increased?

Participants can make any improvements (i.e. renovations) to the property at their own expense. Participants must notify Housing Australia before making home improvements. This notifies Housing Australia that a valuation is required.

- If the cost of the renovations is less than $20,000, the Commonwealth will share in any resultant increase in property value. Caveat: if a participant made two separate renovations, one after the other within up to a 12-month period, this would be treated as one set of costs.

- If the cost of the renovations is more than $20,000, the Commonwealth will reduce its percentage share. For example, purchase price was $500,000 and after renovations the value increased to $540,000. The Government contribution was $100,000. Pre-renovations the Government’s percentage share was 20.0%, post renovations it is reduced to 18.5%.

The purpose of the Help to Buy Scheme is to assist Australians with low or middle-income.

What happens if your income bracket changes?

If your income changes, Housing Australia may require repayment from you or terminate the arrangement. This is dependent on your lender’s assessment and confirming that your new income surpasses the income threshold. If it does:

- Where the Commonwealth’s share is greater than 5% of the property value and the lender assesses you have the capacity to repay a minimum of 5% of the property value, you must repay a minimum amount of 5% (rounded to the nearest $1,000) within 90 days of the assessment date.

- Where the Commonwealth’s share is equal to or less than 5% of the property value, and the lender assesses that you have the capacity to repay in full, you must repay the Commonwealth share in full within 90 days of the date the lender’s assessment was completed.

There are other caveats - example, divorce, death, natural disasters, and others. Participants can exit the arrangement or sell their property. First home buyers MUST read the Treasury Australia website for all possible life situations

First Home Buyer Trends

Post COVID-19 we saw a record amount of first home buyer targeted programs created by Local, State, and Federal Governments. What impact do they have?

Looking at the number of first home buyer loans pre-COVID (in this case, June quarter 2019) versus now (June quarter 2024), it has increased by 23.6% across Australia in the past 5 years; with ACT (80.1%) and NSW (27.9%) leading the pack.

That said, on a yearly basis between June quarter 2023 vs 2024, the number of first home buyer loans have only grown slightly, at 7.2% across Australia; led by the NT (18.8%) and VIC (15.9%). VIC also hold the record for the highest number of first home buyer loans of 10,074 loans, almost double that of QLD (5,680 loans).

The amount of debt first home buyers must commit have also increased, by 41.1% in the past 5 years and 6.8% in the past 12 months to June quarter 2024. In the past 5 years average first home loans in SA and QLD increased the most, by 59.5% and 48.7% respectively. QLD retains this title for the year-on-year growth, increasing by 12.8%, at $505,915 as of June quarter 2024.

Table 3. First Home Buyer Number of Loans and Average Loan Size (Source: Real Estate Institute of Australia, Housing Affordability Reports September 2019, 2023, and 2024).

Table 3 confirms that having more “help” comes with a tangible trade-off. Yes, the number of first home buyers entering the market does increase, but so does the mortgage amount. Hence, less affordability for future buyers in the long run.

The danger with Government schemes is if a first home buyer is over-extended; and unable to service the loan should an unscheduled event occur. Yes, the Help to Buy Scheme does have a price cap, but it can create an illusion of affordability. For example, if a first home buyer could only afford a $500,000 home without the Scheme but committed to a $600,000 home purchase (with the scheme).

Moving Forward

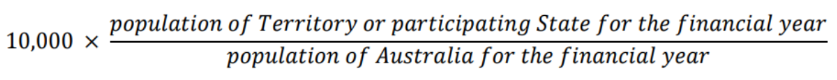

The number of first home buyers that can access the Scheme, in each state, will depend on whether the State choose to participate or not. States like Queensland have their own Housing Finance Loan program, which suggests applicants must choose between the State or Federal scheme. Further, the number of places that is allocated depend on the below formula, as of 2024/2025 financial calendar:

At present, the exact date of when the Help to Buy Scheme is unknown, as is the number of allocations per State. Therefore, its impact on the market is to be seen. That said, history suggests that it will increase first home buyer demand in the market, which, when coupled with the possibility of a cash-rate cut in 2025, can result in a multiplier effect. We could see a record-breaking number of first home buyers due to the Scheme, just like when the Federal Government announced its First Home Loan Deposit Scheme in 2020 and First Home Guarantee in 2022.

The moderator for 2025’s demand is a higher interest rate than COVID-19 times. However, with many “sticky buyers” waiting for the cash rate to move, this may not have the equalising effect that economists and property watchers hope for.

The Help to Buy Scheme is designed to assist low and middle-income households into property ownership sooner than later. Does it do that? Technically, yes. Is it attractive to first home buyers? Of course. Is the devil in the details? Absolutely. Because of this, reading the full details of the Help to Buy Scheme is a MUST.

PRD is an acknowledged industry real estate leader. We've been in the business of selling and managing properties since 1976 and have a strong network of franchise offices Australia-wide.

For further information, or to discuss any aspects of this analysis paper, please contact PRD Chief Economist, Dr Diaswati Mardiasmo at research@prd.com.au.